INDICATA provides valuable insights into the growing challenges of rising used BEV supply

Our INDICATA used car pricing platform has been keeping a close eye on the demand, supply and stock turn profile of Battery Electric Vehicles (BEVs) in Europe since the beginning of 2021.

Used BEVs reported record prices until October 2022

Since used BEVs began to appear in higher numbers in Europe’s key used car markets from early 2021 demand for used BEVs has generally been healthy with INDICATA reporting record prices and falling stock levels.

Then in October the cost of living across Europe started to increase caused by high energy prices and rapidly rising inflation which stopped the healthy demand for used BEVs in their tracks.

Consumers had quickly moved their attention from high priced used BEVs - that were sometime two or three times the price of an ICE car - back to cheaper petrol and diesel models.

Used BEV stock levels continue to rise

Between October 2022 and January 2023 stock levels continued to rise an all-time high with both value and premium brands both affected as our INDICATA graphs show. In December 2022 and January 2023 record levels of used BEVs in stock caused prices to crash some by several thousands of pounds.

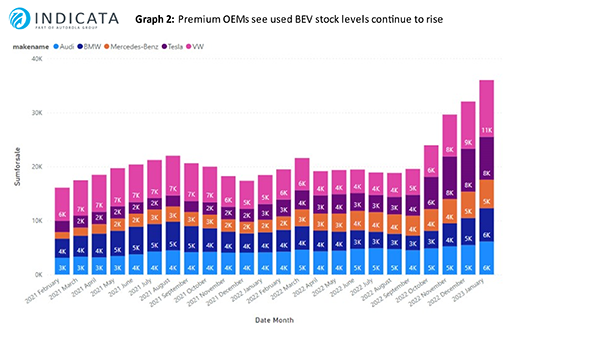

Graph 1 shows how 12 volume brands’ stock supply changed between February 2021 and January 2023 across Europe. Used BEV stock practically doubled between August 2022 and January 2023, with manufacturers such as Peugeot, Nissan and Fiat holding records levels of stock. Ford, Kia and Hyundai stock levels meanwhile have remained very constant over the past two years.

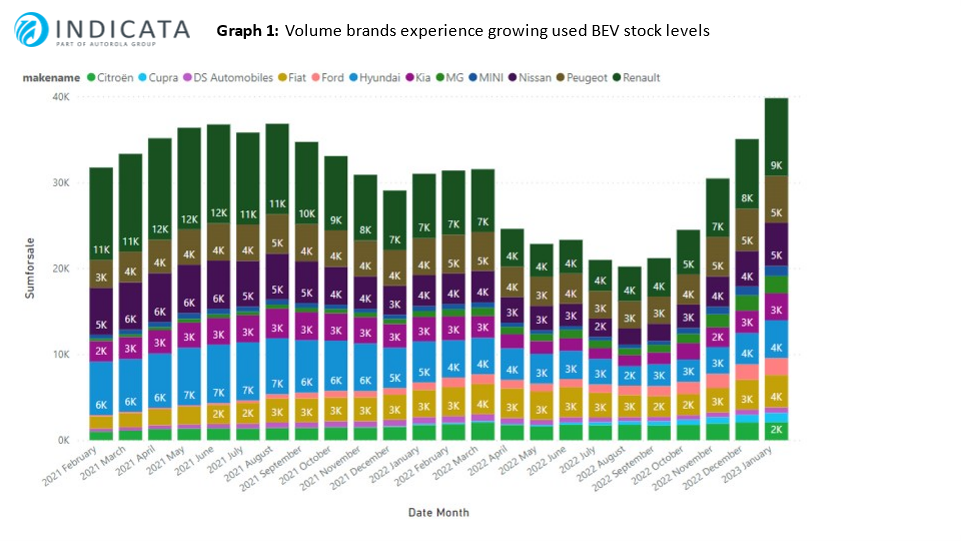

Graph 2 Analysing the used BEV stock levels from the top five premium brands supply also began to quickly ramp up from October 2022 across Europe. VW supply nearly doubled during that period, with Tesla, Mercedes-Benz and BMW also boasting record levels of supply. Meanwhile, supply levels of used Audi BEVs have remained more constant despite the change in market conditions.